Case Studies

Be inspired by some of our client’s experience and business stories. Watch our videos or read case studies of some of our successful clients below to see the support we provide across the South West.

Surviving and Thriving in the Face of Adversity

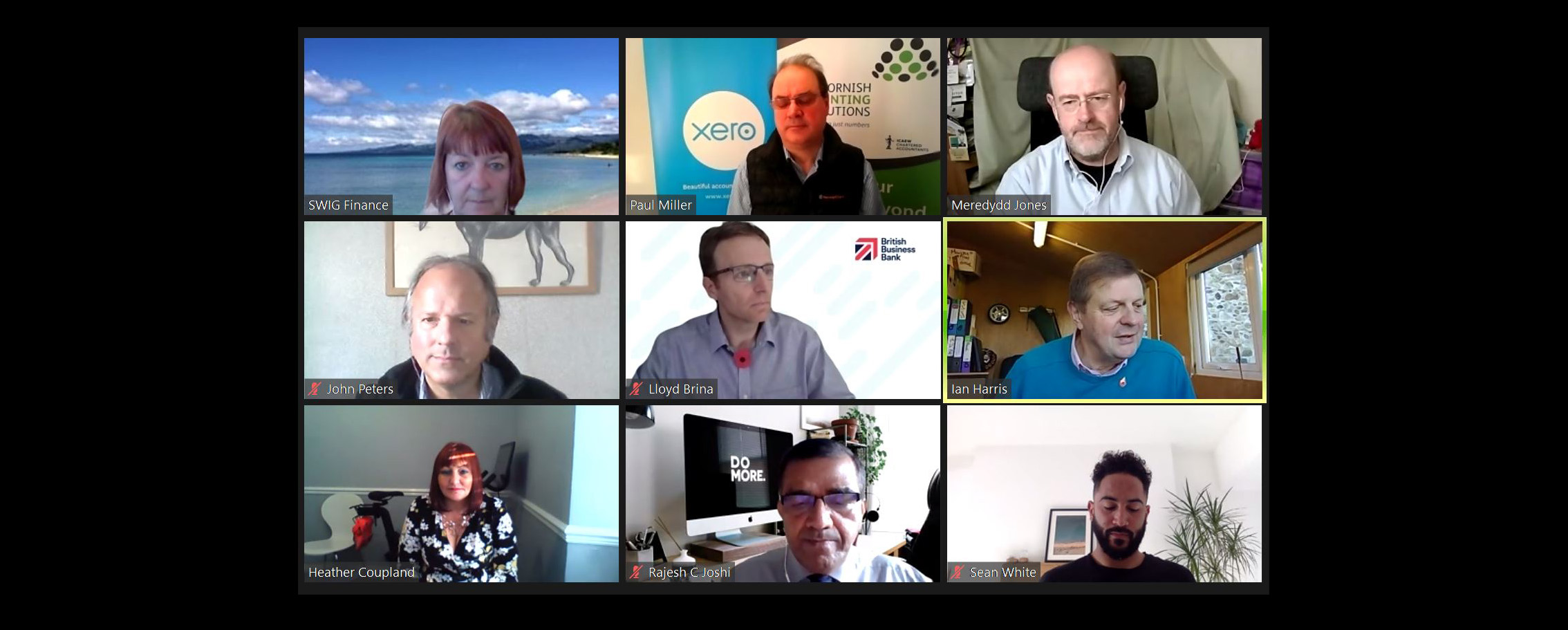

In collaboration with Oxford Innovation Cornwall, we brought together a panel of leading Cornish business experts to discuss how Cornwall’s business community can begin to recover following the economic downturn caused by COVID-19.

During the webinar, we asked our panel of specialists what businesses can do to transform their models towards growth in the current business climate and what is needed next to support growth and innovation for Cornish businesses.

“Exploit the new market conditions to establish a competitive advantage” was the primary comment from the discussion. Following this roundtable debate, we dissect the diverse range of opinions to breakdown how businesses can begin to do this.

Surviving and Thriving in the Face of Adversity – the key takeaways;

“Adopt a trans-seasonal model for your seasonal business”

Sean White, Founder of WeSUP HQ, took a forensic approach to pivoting his business model from a seasonal business model to a trans-seasonal business model. Sean said “We weren’t focusing enough on local people – we were not giving local people a reason to be proud of where they live. We wanted to do more to educate people on how incredible the access to water is; how they can be a part of ‘coffee culture’ in the South West; and what it really means to shop local and support your local businesses”. Sean said that once they started to engage more with their local customers, they were immediately able to drive more revenue into the business. This now means that the local economy provide their main income stream and the tourist population now bring in the extra revenue. ”When you can inspire people to support your business all year round, it’s natural that revenue can be driven in a new way” Sean said. He comments that the business is now sustainable through the local economy.

“Ensure you are getting value for money”

Paul Miller, Managing Director at Cornish Accounting Solutions, took a financially focused view. Paul suggests that businesses look at their cost and expenditure. Paul comments that business owners should review their direct debits and standing orders to make sure that these costs are necessary, this applies to personal finances as well. “Are you getting value for money from these expenditures? Do you actually need it?” This is the first step in reducing your costs. “Cost is easier to control than income” Paul remarked.

“Adapting is key to survival, and alignment is key to adapting”

John Peters, Managing Director at SWIG Finance, explained that their business model had been forced to transition into an online business. They key to the successful transition was in ensuring that the team were aligned with and informed about the changes and challenges. The adoption of technology has greatly helped with by enabling continuous internal communication, as well as external communication, John said.

“The best thing you can do is the right thing, the second-best thing you can do is the wrong thing. The worst thing you can do is nothing”.

Continuing with the theme of adapting, Meredyyd Jones, High Growth Business Coach at Oxford Innovation observed “The one thing business cannot do is stand still”. Meredydd suggests that business take time to reflect on the situation and reach out to support programmes, like Oxford Innovation, to take advantage of the support that is available.

“Planning is vital to success”

Ian Harris, Non-Executive Director for Cornwall Care discussed the need for planning “if you have a plan, you’ll know where you are” he said. He reinforced that COVID-19 should be factored into every aspect of your planning, especially business development.

Heath Coupland, Programme Delivery Manager for Access to Finance Cornwall, echoed the points raised regarding pivoting and how you can plan for this; “Pivoting is a really important factor to be considering. From a practical perspective, it means looking at our assets, our skills and our knowledge, and looking at how we can use those effectively to increase sales and change our business models.” Many of our experts talk about pivoting, Heather takes a closer look at how businesses can do that by highlighting the main point for consideration; “What do you have in your business? What assets do you have that you can put to good use?” Heather also points out that financial management will be crucial in today’s markets, really understanding your cashflow cycle and profitability will help to protect your business. If you need support in this area, “Ask for help!” Heather said. There are plenty of organisations out there who can assist you, particularly when it comes for cash flow forecasts – that is what Access to Finance is here for and there is no charge for this service.

“Get used to disruption”

Rajesh C Joshi, CEO for Bodmin Jail Hotel and business turnaround specialist pointed out that we, as a business community, need to anticipate disruption. Rajesh spoke about the need for being aware of trends and how these might affect your business in both short- and long-term. Rajesh also discussed Common Sense Principles. “Be true to your position”, Rajesh said, “if you have a strategy, follow it through. There will be elements which can be pivoted, but do not start second guessing yourself”.

“Challenge breeds opportunity, but financial stress breeds bad decisions”

Lloyd Brina, Senior Manager for Cornwall and Isles of Scilly ,UK Network at British Business Bank commented that he has seen a lot of examples of entrepreneurs stepping up to respond by trying out new things. However, Lloyd pointed out that one of the biggest challenges in today’s market is managing stress, as pressurized situations often causes many people to make illogical decisions. “These things can really affect your mindset and your ability to innovate and to do what is necessary to thrive and survive. Now really is the time to reach out, get help, and gain the perspective you need to develop your plans”.

Sean White expanded on this point sharing his own experiences “so many times, we have been underinvested in, in both time and resource. When you are under financial stress and your back is against the wall, you make terrible decisions – the worst decisions. So, businesses having the opportunity to be properly invested in would be enormously beneficial to the economy.”

“Business can be a lonely environment”

Paul Miller suggests the peer-to-peer networks could be a big role is the future of business. “Make a network of people whose opinions you trust. Remember you aren’t the only one struggling with things and work with your network to develop a solution. For me, by explaining problems to other people, I come to realise the solution. Sometimes it just about reassurance that you are making the right decision”.

Meredydd Jones continued the theme of peer-to-peer networks by highlighting that this is something that Oxford Innovation are currently working on. Oxford innovation can help support you with all aspects of business, not just your financials. 1-2-1 support can help you develop your plans, including your business plans, to help you move your business forward. This covers everything from your business’ ethos, what you are trying to achieve. “Doing business without passion is pointless. You need to have drive and passion if you want your business to succeed. It’s critical that the people around you need to share this outlook as well” Meredydd said.

Ian Harris commented that strategic framework that will play an important role in helping businesses to survive and thrive, “A problem shared is a problem halved” Ian said. Ian highlighted the importance of a solid Board; “You need to have the right people, in the right place at the right time” Ian suggests investing in a non-exec director, although Ian was quick to point out that this is costly, however, the benefits will outweigh the costs.

“Finding the finance that is right for your business”

Focusing on financial support available, John Peters from SWIG Finance discussed the diverse range of support available to Cornish businesses. As well as Oxford Innovation and Access to Finance, John also highlighted the Cornwall and Isles of Scilly Investment Fund, and the Cornwall and Isles of Scilly Growth Hub.

Lloyd Brina briefly discussed the changes to the government-backed BBLS and CBILS schemes. The BBLS scheme has now been modified so that businesses who received less than £50k in funding could now apply for more funding under the revised scheme He urged businesses to explore whether this could be beneficial for them.

View the debate here:

Start Up Loan for Eco Footwear with a Motorsport Soul

Inventor, Alex Witty, aims to convert motorsport fans & sneakerheads with his sustainable recycled footwear.

Cornish Entrepreneur Turns Food Waste into Textiles Dye

A Cornish entrepreneur secures a £17k Start Up Loan to support his business turning food waste into textiles dye.

Argentinian-Inspired Asado Grill Company Scales Up

An Argentinian-inspired Asado Grill company has scaled up, thanks to successive funding delivered by SWIG.

Health Hub Breathes New Life into a Derelict Former Bank

A one-stop health hub has breathed new life into a derelict former bank in Bristol, with help from SWIG Finance.

Wiltshire Builder Develops Compact Housing Solution

A Wiltshire businessman has devised an alternative housing solution thanks to a £25k Start Up Loan.

Truro Microbrewery Celebrates a Year in Business

Truro microbrewery, Mason Brewing Co, is celebrating a year in business, thanks to a £15k Start Up Loan.

Start Up Loan Funding for Event Styling Franchise

Mihaela Cociuba has received a £20k Start Up Loan to invest in the South Devon franchise of Ambience Venue Styling UK.

Female Empowerment Mentor Receives Start Up Funding

Susie Mackie, from Cheltenham, has secured a £5k Start Up Loan to help women build mental resilience.

Boost for elderly nutrition with a £25k Start Up Loan

A Gloucestershire company specialising in nutritious snack bars for older people has secured a £25k Start Up Loan.

Newquay Business Rides Wave of Success

A Cornish outdoor activity provider has secured a £26,000 funding boost to scale up and meet increasing demand.

Funding for Environmental Services Business

Bristol, Map Impact, has received £250k from SWIG Finance in a bid to take its environmental mission global.

Truro Café Offers Healthy Drinks with help from Start Up Loans

A new café in Truro focusing on healthy drinks has received a £4k Start Up Loan.