SWIG Finance is delighted to share its 2020/21 Social Impact Report following what has been a very challenging year.

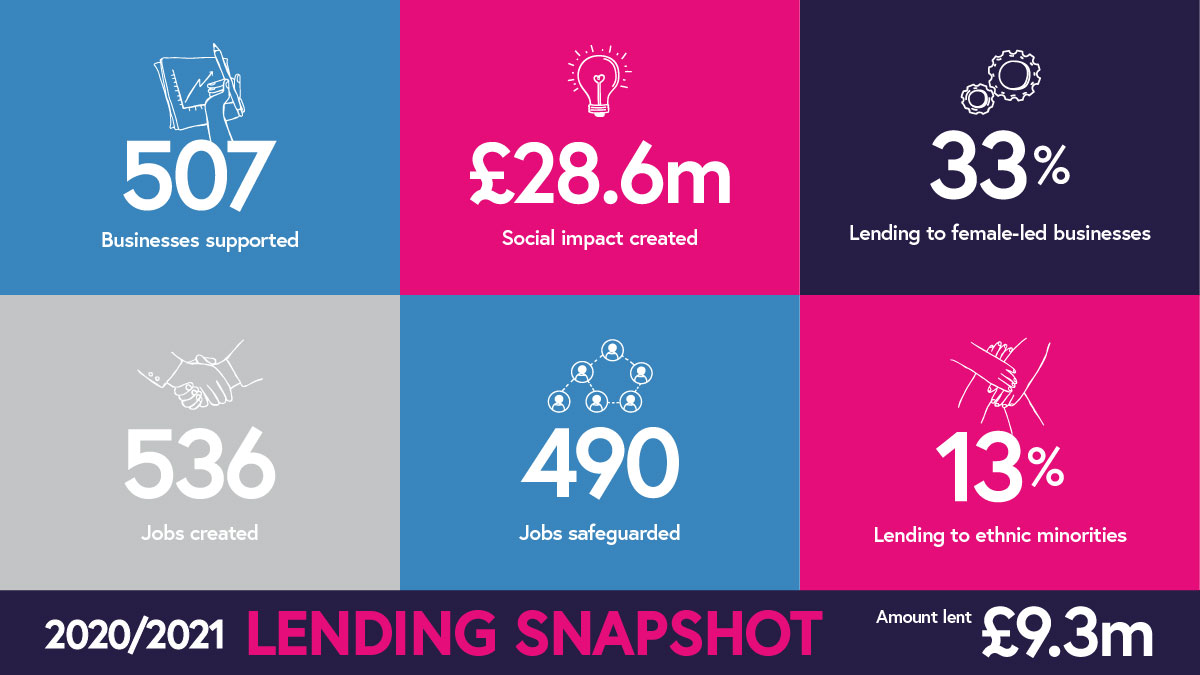

We supported more businesses than ever before, delivering a record £9.3 million in loans to start-up and established businesses throughout the South West.

Our funding was a critical lifeline for many of the businesses we supported – though 25% of our lending was for growth and 38% for start-ups. It helped to create 536 new jobs and safeguard another 490, which has generated more than £28.6 million in social impact to our region’s economy.

It goes without saying that these statistics are a little bittersweet, with the COVID-19 pandemic causing widespread disruption which meant that businesses required support at an unprecedented level.

SWIG Finance’s Chairperson, Christine Allison, commented; “The nature of the pandemic and the way it impacted different sectors of the economy and different regions highlighted the importance of having a variety of lenders. The personal and bespoke nature of CDFIs like SWIG Finance, coupled with local knowledge make them a natural complement to other lenders: we can lend into parts of the economy that are beyond the reach – and risk appetite – of the banks”.

As the pandemic took its grip back in April 2020, SWIG Finance was proud to be able to step up and become accredited as a delivery partner for British Business Bank’s Coronavirus Business Interruption Loan Scheme.

SWIG itself was not exempt from disruption, having to adapt to a very different working environment almost overnight. Notwithstanding this, every team member played their role in ensuring the company could continue delivering finance to those viable businesses that needed it the most.

Managing Director John Peters said, “I am very proud that SWIG was able to rise to the challenge and supported so many businesses during such difficult times, and the fact that we did so is testament to the dedication and professionalism of our staff, and the resolute support of our directors.”

“Whilst this has been the most challenging of years, the optimism, adaptability and creativity of our region’s SMEs and Start Ups shows real resilience and determination to “build back better””.

As we move towards economic recovery SWIG Finance has become an accredited delivery partner for the BBB’s Recovery Loan Scheme, which means we can continue to support those SMEs who still require funding to overcome disruption, as well as those needing investment to grow.

We will continue working to empower underserved businesses in the region to overcome their financial barriers, which in turn will help to create a more balanced financial eco-system.

About SWIG Finance

SWIG Finance is the South West’s leading Community Development Financial Institution. We are passionate about bringing social and economic benefits to people and places in the South West.

We do this by providing support and finance to Start Ups and growing SMEs that can create and secure employment opportunities.

As the South West’s leading delivery partner for Start Up Loans UK, we can provide Start Up Loans from £500 – £25,000. For more information visit https://www.swigfinance.co.uk/start-up-loans/

We also have business loans from £25,001 to £250,000 available to South West SMEs who cannot access sufficient funding from their bank https://www.swigfinance.co.uk/business-loans/

If you would like to have an informal discussion about your funding requirements, get in touch with our friendly and professional team to find out how we can help: info@swigfinance.co.uk / 01872 227 930.